In Cost Sheet Depreciation Of Office Furniture Is Included In . The furniture’s initial cost, accumulated depreciation, and net book value must be included in the balance sheet. Usually, companies can choose between various approaches to the. How is depreciation calculated for furniture and fixtures? Depreciation is an important accounting tool used to spread the cost of office equipment over its useful life. Learn effective strategies for managing office equipment costs and understanding depreciation to optimize your. A cost sheet is a document used in managerial accounting that provides a detailed breakdown of the costs associated with. Cost sheet is a statement, prepared at given intervals of time, which provides information regarding elements of cost incurred. What is the useful life of furniture and fixtures? What happens when furniture and. Depreciation is a method to spread an asset’s cost over several periods.

from www.numerade.com

Cost sheet is a statement, prepared at given intervals of time, which provides information regarding elements of cost incurred. Depreciation is a method to spread an asset’s cost over several periods. Depreciation is an important accounting tool used to spread the cost of office equipment over its useful life. How is depreciation calculated for furniture and fixtures? What is the useful life of furniture and fixtures? Learn effective strategies for managing office equipment costs and understanding depreciation to optimize your. The furniture’s initial cost, accumulated depreciation, and net book value must be included in the balance sheet. Usually, companies can choose between various approaches to the. A cost sheet is a document used in managerial accounting that provides a detailed breakdown of the costs associated with. What happens when furniture and.

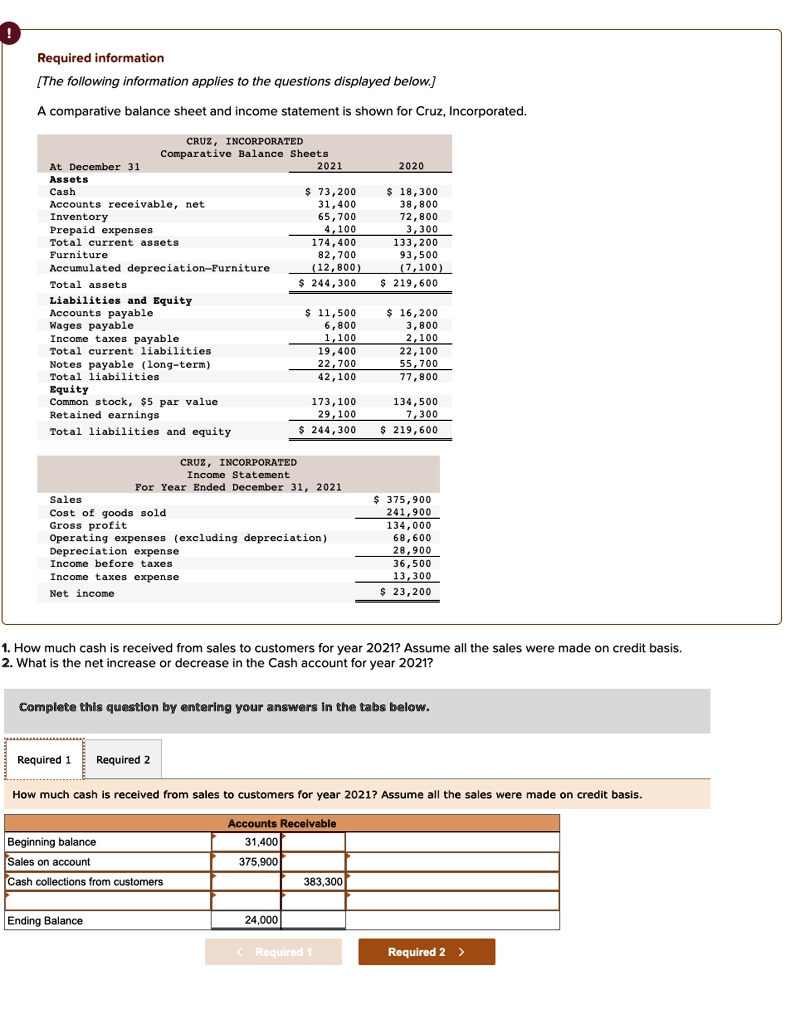

SOLVED CRUZ, INCORPORATED Comparative Balance Sheets 2021 At December

In Cost Sheet Depreciation Of Office Furniture Is Included In Learn effective strategies for managing office equipment costs and understanding depreciation to optimize your. Usually, companies can choose between various approaches to the. Learn effective strategies for managing office equipment costs and understanding depreciation to optimize your. Depreciation is a method to spread an asset’s cost over several periods. Cost sheet is a statement, prepared at given intervals of time, which provides information regarding elements of cost incurred. The furniture’s initial cost, accumulated depreciation, and net book value must be included in the balance sheet. What happens when furniture and. What is the useful life of furniture and fixtures? A cost sheet is a document used in managerial accounting that provides a detailed breakdown of the costs associated with. How is depreciation calculated for furniture and fixtures? Depreciation is an important accounting tool used to spread the cost of office equipment over its useful life.

From www.investopedia.com

Are depreciation and amortization included in gross profit? In Cost Sheet Depreciation Of Office Furniture Is Included In Cost sheet is a statement, prepared at given intervals of time, which provides information regarding elements of cost incurred. Learn effective strategies for managing office equipment costs and understanding depreciation to optimize your. Usually, companies can choose between various approaches to the. How is depreciation calculated for furniture and fixtures? What is the useful life of furniture and fixtures? What. In Cost Sheet Depreciation Of Office Furniture Is Included In.

From lloydkeelin.blogspot.com

Calculate depreciation of furniture LloydKeelin In Cost Sheet Depreciation Of Office Furniture Is Included In The furniture’s initial cost, accumulated depreciation, and net book value must be included in the balance sheet. Depreciation is an important accounting tool used to spread the cost of office equipment over its useful life. Depreciation is a method to spread an asset’s cost over several periods. A cost sheet is a document used in managerial accounting that provides a. In Cost Sheet Depreciation Of Office Furniture Is Included In.

From charliemontford.blogspot.com

Macrs Depreciation Table Furniture CharlieMontford In Cost Sheet Depreciation Of Office Furniture Is Included In A cost sheet is a document used in managerial accounting that provides a detailed breakdown of the costs associated with. Depreciation is an important accounting tool used to spread the cost of office equipment over its useful life. Depreciation is a method to spread an asset’s cost over several periods. What is the useful life of furniture and fixtures? Learn. In Cost Sheet Depreciation Of Office Furniture Is Included In.

From ninasoap.com

Depreciation Worksheet PDF Nina's Soap In Cost Sheet Depreciation Of Office Furniture Is Included In How is depreciation calculated for furniture and fixtures? What happens when furniture and. Learn effective strategies for managing office equipment costs and understanding depreciation to optimize your. The furniture’s initial cost, accumulated depreciation, and net book value must be included in the balance sheet. Depreciation is an important accounting tool used to spread the cost of office equipment over its. In Cost Sheet Depreciation Of Office Furniture Is Included In.

From www.numerade.com

SOLVED CRUZ, INCORPORATED Comparative Balance Sheets 2021 At December In Cost Sheet Depreciation Of Office Furniture Is Included In Cost sheet is a statement, prepared at given intervals of time, which provides information regarding elements of cost incurred. What is the useful life of furniture and fixtures? How is depreciation calculated for furniture and fixtures? A cost sheet is a document used in managerial accounting that provides a detailed breakdown of the costs associated with. Learn effective strategies for. In Cost Sheet Depreciation Of Office Furniture Is Included In.

From www.homeworklib.com

6. Depreciation methods Firms can use various methods to calculate In Cost Sheet Depreciation Of Office Furniture Is Included In Cost sheet is a statement, prepared at given intervals of time, which provides information regarding elements of cost incurred. What happens when furniture and. A cost sheet is a document used in managerial accounting that provides a detailed breakdown of the costs associated with. Learn effective strategies for managing office equipment costs and understanding depreciation to optimize your. How is. In Cost Sheet Depreciation Of Office Furniture Is Included In.

From templates.rjuuc.edu.np

Depreciation Schedule Excel Template In Cost Sheet Depreciation Of Office Furniture Is Included In Depreciation is an important accounting tool used to spread the cost of office equipment over its useful life. How is depreciation calculated for furniture and fixtures? A cost sheet is a document used in managerial accounting that provides a detailed breakdown of the costs associated with. Learn effective strategies for managing office equipment costs and understanding depreciation to optimize your.. In Cost Sheet Depreciation Of Office Furniture Is Included In.

From www.chegg.com

Solved a. Sold at a gain of 7,000 furniture and fixtures In Cost Sheet Depreciation Of Office Furniture Is Included In What is the useful life of furniture and fixtures? Depreciation is an important accounting tool used to spread the cost of office equipment over its useful life. Learn effective strategies for managing office equipment costs and understanding depreciation to optimize your. Cost sheet is a statement, prepared at given intervals of time, which provides information regarding elements of cost incurred.. In Cost Sheet Depreciation Of Office Furniture Is Included In.

From www.educba.com

Depreciation Expenses Formula Examples with Excel Template In Cost Sheet Depreciation Of Office Furniture Is Included In Usually, companies can choose between various approaches to the. Depreciation is a method to spread an asset’s cost over several periods. Cost sheet is a statement, prepared at given intervals of time, which provides information regarding elements of cost incurred. The furniture’s initial cost, accumulated depreciation, and net book value must be included in the balance sheet. What happens when. In Cost Sheet Depreciation Of Office Furniture Is Included In.

From www.caselle.com

Depreciation Schedule In Cost Sheet Depreciation Of Office Furniture Is Included In Depreciation is a method to spread an asset’s cost over several periods. What happens when furniture and. How is depreciation calculated for furniture and fixtures? Depreciation is an important accounting tool used to spread the cost of office equipment over its useful life. Learn effective strategies for managing office equipment costs and understanding depreciation to optimize your. A cost sheet. In Cost Sheet Depreciation Of Office Furniture Is Included In.

From open.lib.umn.edu

10.2 Determining Historical Cost and Depreciation Expense Financial In Cost Sheet Depreciation Of Office Furniture Is Included In What is the useful life of furniture and fixtures? Cost sheet is a statement, prepared at given intervals of time, which provides information regarding elements of cost incurred. Depreciation is a method to spread an asset’s cost over several periods. Learn effective strategies for managing office equipment costs and understanding depreciation to optimize your. Depreciation is an important accounting tool. In Cost Sheet Depreciation Of Office Furniture Is Included In.

From atotaxrates.info

ATO depreciation rates and depreciation schedules AtoTaxRates.info In Cost Sheet Depreciation Of Office Furniture Is Included In Depreciation is a method to spread an asset’s cost over several periods. A cost sheet is a document used in managerial accounting that provides a detailed breakdown of the costs associated with. Depreciation is an important accounting tool used to spread the cost of office equipment over its useful life. Usually, companies can choose between various approaches to the. The. In Cost Sheet Depreciation Of Office Furniture Is Included In.

From www.chegg.com

Solved Weaver Company Comparative Balance Sheet at In Cost Sheet Depreciation Of Office Furniture Is Included In How is depreciation calculated for furniture and fixtures? Depreciation is a method to spread an asset’s cost over several periods. Depreciation is an important accounting tool used to spread the cost of office equipment over its useful life. The furniture’s initial cost, accumulated depreciation, and net book value must be included in the balance sheet. What happens when furniture and.. In Cost Sheet Depreciation Of Office Furniture Is Included In.

From odora.tinosmarble.com

Depreciation Methods 4 Types of Depreciation You Must Know! In Cost Sheet Depreciation Of Office Furniture Is Included In Usually, companies can choose between various approaches to the. What is the useful life of furniture and fixtures? A cost sheet is a document used in managerial accounting that provides a detailed breakdown of the costs associated with. Depreciation is a method to spread an asset’s cost over several periods. Cost sheet is a statement, prepared at given intervals of. In Cost Sheet Depreciation Of Office Furniture Is Included In.

From db-excel.com

Asset Management Spreadsheet Template 1 Management Spreadsheet Budget In Cost Sheet Depreciation Of Office Furniture Is Included In Depreciation is a method to spread an asset’s cost over several periods. What is the useful life of furniture and fixtures? Cost sheet is a statement, prepared at given intervals of time, which provides information regarding elements of cost incurred. Learn effective strategies for managing office equipment costs and understanding depreciation to optimize your. Usually, companies can choose between various. In Cost Sheet Depreciation Of Office Furniture Is Included In.

From printablelibfester.z13.web.core.windows.net

Depreciation Table Excel Template In Cost Sheet Depreciation Of Office Furniture Is Included In How is depreciation calculated for furniture and fixtures? A cost sheet is a document used in managerial accounting that provides a detailed breakdown of the costs associated with. Cost sheet is a statement, prepared at given intervals of time, which provides information regarding elements of cost incurred. What is the useful life of furniture and fixtures? Depreciation is a method. In Cost Sheet Depreciation Of Office Furniture Is Included In.

From msofficegeek.com

ReadyToUse Cost Sheet Template MSOfficeGeek In Cost Sheet Depreciation Of Office Furniture Is Included In Depreciation is an important accounting tool used to spread the cost of office equipment over its useful life. What happens when furniture and. What is the useful life of furniture and fixtures? Depreciation is a method to spread an asset’s cost over several periods. The furniture’s initial cost, accumulated depreciation, and net book value must be included in the balance. In Cost Sheet Depreciation Of Office Furniture Is Included In.

From www.journalofaccountancy.com

8 ways to calculate depreciation in Excel Journal of Accountancy In Cost Sheet Depreciation Of Office Furniture Is Included In Learn effective strategies for managing office equipment costs and understanding depreciation to optimize your. A cost sheet is a document used in managerial accounting that provides a detailed breakdown of the costs associated with. How is depreciation calculated for furniture and fixtures? What happens when furniture and. The furniture’s initial cost, accumulated depreciation, and net book value must be included. In Cost Sheet Depreciation Of Office Furniture Is Included In.